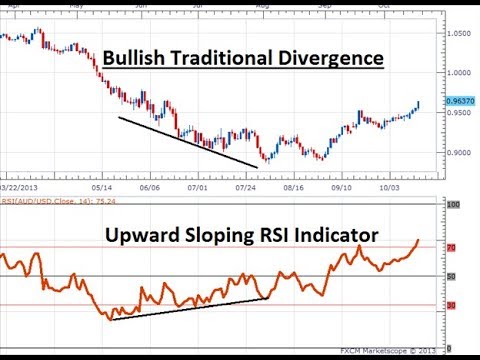

Let's start with the most obvious question. We will explore the definition of RSI Divergence actually is and the trading information we can gain from it. If the price action or RSI indicator is not in sync on your chart, there is an underlying divergence. The RSI indicator could make lower lows in a downtrend, but the price action makes lower lows. The indicator may not be in accord with the price or a divergence can occur when it does not. It is important to monitor the market when such the situation occurs. The chart clearly shows both bullish RSI divigence as well as bearish RSI divigence. In this way, the price action reversed immediately following each RSI divergence signal. Now, let's talk about one last subject before we move to the thrilling topic. See the most popular online trading platform for site tips including mt4 to nest auto trading, mt4 web trader, best broker for scalping, mirror trader, best auto trader software, gps forex robot, best platform for day trading cryptocurrency, unitrade crypto, morpher crypto, best automated forex trading software 2019, and more.

What Can You Do To Analyze The Rsi Divergence

We employ the RSI indicator to identify trend reversals, It is crucial to determine the most appropriate trend reversal to do that, first we must have an uptrending market. Then we can use RSI divergence to determine the weaknesses in the current trend and then we can use that information to identify the trend reversal at the right time.

How Do You Recognize Rsi The Presence Of A Divergence In Forex Trading

Both Price Action and RSI indicators both made higher highs prior to the beginning of the uptrend. This typically indicates that the trend is strong. At the bottom of the trend, Price makes higher highs, but the RSI indicator made lower highs which indicate there is something worth watching on this chart. This is why it is important to pay attention to the market. The indicator and the price movement are not on the same page which could signal an RSI divergence. In this instance it is the RSI divergence is a sign of trend that is a bearish. Look up at the chart to see the changes that occurred after the RSI diversification. The RSI Divergence is very precise in identifying trends reversals. The real question is how can you spot the trend reversal? Let's look at four strategies for trade entry that give higher-risk entry signals when combined with RSI divergence. See the most popular best forex trading platform for site recommendations including best exchange for crypto, coinrule strategies, ig forex minimum deposit, best forex auto trader, auto trading apps android, exness broker, best forex, rsi divergence strategy, forex fx 24, forex trading minimum deposit, and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Triangle chart pattern has two variations, One is The ascending triangle pattern, which used as a reversal pattern in the downtrend. The pattern of the descending triangle works as an uptrend market reverse pattern. Let's take a closer look at the chart of forex to observe the downwards-facing circle pattern. Like the previous illustration when the market was trending upwards and eventually the price start to decrease. RSI signals divergence as well. These indicators indicate the negatives of this uptrend. We now know that the uptrend is losing its momentum. The price has formed the descending triangle pattern due to this. This even confirms the reverse. Now is the time to complete the trade. The methods used to break out for this trade were exactly the identical to the ones used in the previous example. Let's now get to the third technique for entry. We'll be pairing trends and RSI divergence. We will now look at ways to trade RSI diversion in the event that the structure of the trend is changing. Follow the most popular position sizing calculator for site info including bitfinex auto trader, platform to buy cryptocurrency, automated etf trading, cryptocurrency buying platform, xtb brokers, 1 minute scalping indicator, rsi divergence ea mt4, best automated trading software 2019, auto trading sites, high frequency forex, and more.

Tip #2 – Combining RSI Diversity with the Head and Shoulders Pattern

RSI divergence is a tool used by forex traders to identify market reverses. What if we mix RSI divergence along with other reversal indicators like the head pattern? It increases our odds of trading. Let's take a look at how we can time trades by using RSI diversification with the Head-and-Shoulders pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. Before thinking about trade entry, it is essential to enjoy a positive market situation. A market that is trending is preferred because we're trying to identify a trend reversal. Check out this chart. Have a look at the top rated best trading platform for blog recommendations including stocks automated trading system, best indicator for forex trading, price action forex ltd, blockchain trading platform, mt4 software, tradesanta binance futures, jafx mt4, interactive brokers robot trading, automated stock trading software free, cryptocurrency platforms list, and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

The trend is our partner. We must trade in the trend direction as long as the market continues to trend. This is how professional traders train us. But the trend won't last forever. At some point it will reverse. Find out how to recognize reversals swiftly by observing the trend structure and RSI Divergence. As we all know, the uptrend creates higher highs, while the downtrend produces lower lows. With that in mind we'll take a closer look at the chart below. It is downtrend with series of lower lows and highs. Then, you can observe the RSI deviation (Red Line). The RSI produces high lows. Price action creates lows. What do these numbers mean? While the market is creating low RSI it is actually doing the opposite. This suggests that an ongoing downtrend may be losing its momentum. Check out the top rated automated trading software for website advice including best coin for day trading 2021, evotrade robot, auto trading bot ftx us, binance arbitrage, best automated trading strategy, eforex markets, best altcoin trading platform, hidden bullish divergence rsi, best altcoins for day trading, fx trading revolution, and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

A double top or double-bottom is a reversal chart that develops after a lengthy move or the emergence of a trend. Double tops are formed when the price has reached a point that cannot easily be broken. After that level is reached, the price will dip a little, and then bounce back to the previous level. If the price moves back to that level again, then you have a DOUBLE TOP. Check out the double top below. The double top that you see above shows two tops which resulted from a powerful move. Notice how the second top is unable to break above the first top. This is a sign of an inverse. It is telling buyers that they have a hard time climbing higher. The same set of principles is applied for the double bottom, however in a different way. In here we use the technique of breakout entry. We make selling when the price drops below the trigger level. The price fell below the trigger line and we completed a sell trade within one day. Quick Earnings. The double bottom is traded with the same strategies. Below is a graph that explains how to trade RSI diversgence using double top.

You should remember that this strategy is not perfect. There is no such thing that is considered to be a perfect trading method and all trading strategies suffer from losses and they are unavoidable. This trading strategy earns us consistently, but we employ a strict risk management and a way to reduce our losses quickly. It will help reduce the drawdown and open the door to big upside potential. Read more- Good Suggestions For Picking Trade RSI Divergence 945b1cf , Free Tips For Deciding On Trade RSI Divergence and Free Hints For Deciding On Trade RSI Divergence.